Nestled in the picturesque city of Roseville, California, Fiddyment Ranch stands out as a premier…

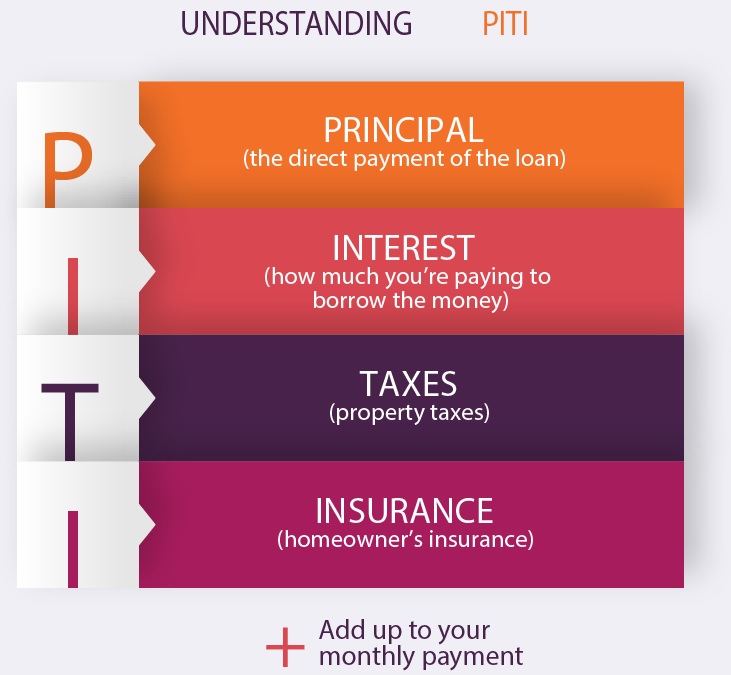

WHAT IS PITI – MORTGAGE PAYMENT BASICS

What exactly does PITI stand for in mortgage terms?

PITI – is an acronym for the breakdown of what’s included in your mortgage payment.

P – Principal

I – Mortgage Interest

T – Property Taxes

I – Homeowners Insurance

Lenders will calculate your PITI payment before approving you for a loan.

Principal

This is the amount that is the outstanding balance on your mortgage. If buy a house for $200,000 and put $20,000 as a down payment, your Principal BALANCE would be $180,000. However, this is NOT the Payoff amount. Your principal portion in your payment is applied to the balance of your loan.

Interest

Interest is the portion of your payment that is collected by the lender. This is based on your current loan balance, the term of the loan and your interest rate. The interest is revenue made by your lender for lending you the money for your home.

Interest for a mortgage is based on an amortization scale. Each month, as your principal balance is reduced, the interest portion of your payment goes down while the principal portion goes up. You can pull up your amortization schedule or reach out to us and we can provide you with the calculation.

Taxes

If you own real estate, you will have to pay property taxes. Property taxes are collected by your county and can be a part of your mortgage payment. Each state has a different property tax calculation. Also, depending on where you live, you might have additional assessments. New built communities tend to have higher property taxes while older communities tend to have lower property taxes.

Property taxes can increase every year. The county assessor will determine a new value and issue the homeowner a tax bill. In California specifically, the state tax rate is 1% based on the value of the home. When you purchase a home, your new value is the purchase price. The county tax assessor in California can increase the value of your home by 2% max per year. Homeowners that have been in their homes for long periods of time tend to have much lower property taxes since appreciation has outpaced the 2% cap.

Property taxes go to pay for public services such as fire stations, police, public schools, roads and road maintenance, parks, community development projects and many other public services.

Insurance

Insurance is the last but not leaset of your PITI. Even though homeowners insurance is not required by law, most people have insurance to protect their home in case of natural disasters such as fire, lightning storm, break ins and other events. If you have a loan against the house, your lender will REQUIRE you to have homeowners insurance even though it doesn’t have to be part of your monthly mortgage payment. This is to make sure the house they issue a loan on is protected.

Homeowners insurance can also protect valuables inside the house such as jewelry, artwork, and other high value items. If you live in a condominium, sometimes the Homeowners Association will provide coverage in lieu of homeowners insurance but it is always wise to check the coverage and details of the policy.

If you live in a FLOOD ZONE as designated by FEMA, your lender will also require you to have Flood Insurance. Certain high fire areas specifically in CA, you might have to take advantage of the FAIR plan which is Federally issued fire insurance. This is because many insurance companies will not provide fire insurance due to high fire risk.